Redesigning International Remittance App

Project Overview:

A fintech company specializing in cross-border payments is redesigning its application to evolve into a global-leading remittance and financial services platform. The new “super app” will target large retail clients and integrate multiple services including remittance, insurance, bill payments, and e-KYC within a unified ecosystem. The redesign will prioritize a seamless user experience across Android and iOS, featuring both light and dark modes for accessibility and modern appeal.

The Problem:

Poor User Experience: Existing platforms do not provide an intuitive, consistent, or modern interface across devices, leading to low user retention.

Accessibility Gaps: The old financial app lack inclusive design elements (e.g. dark mode, localized languages, and simplified onboarding) that appeal to diverse global users.

Limited Cross-Border Payment Options: The old app services are often slow, and lack transparency in exchange rates and transaction fees.

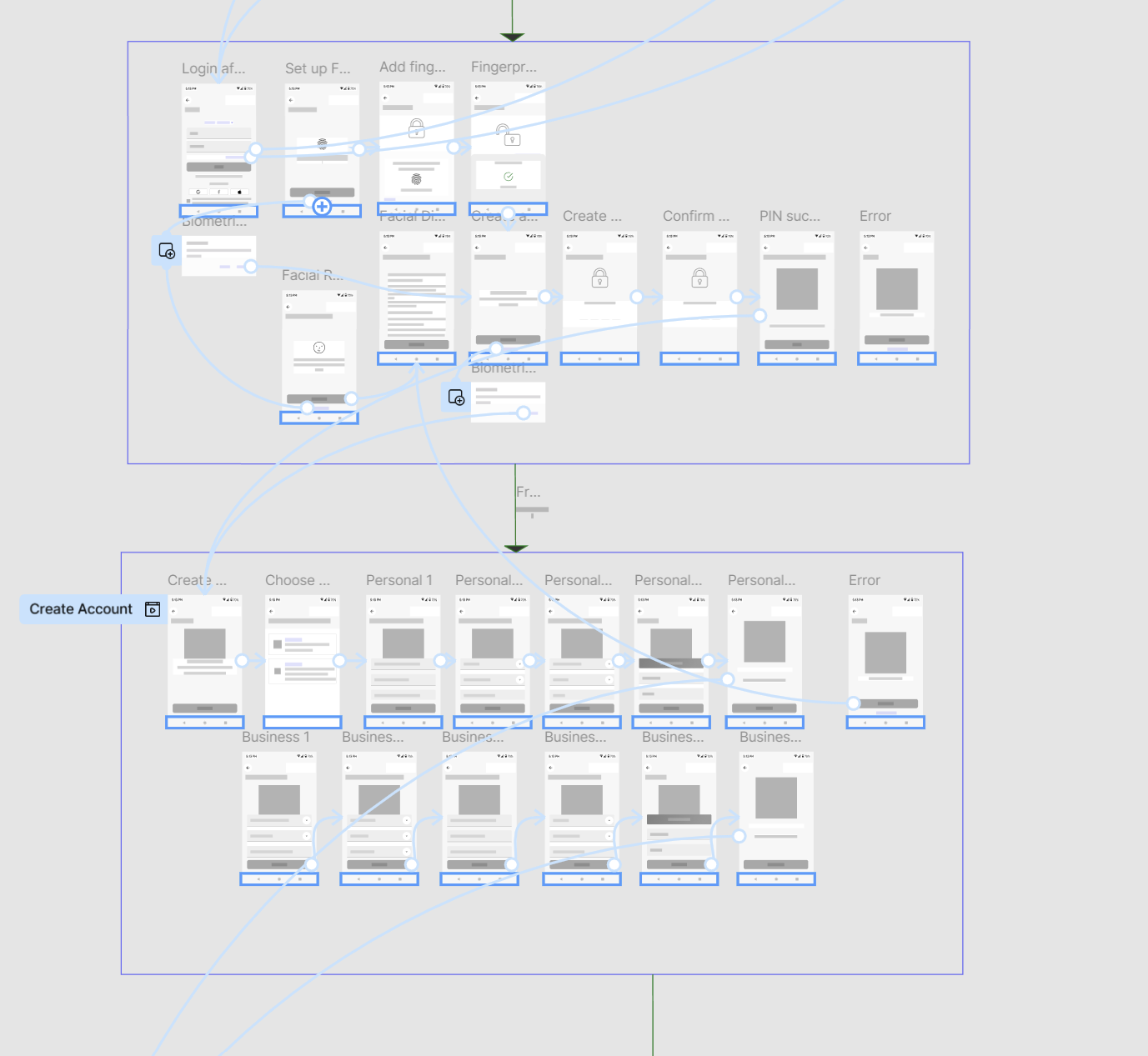

Regulatory and Verification Challenges: Poor integrated electronic Know Your Customer (e-KYC) systems creates friction in compliance and delays user onboarding.

The Goal:

The goal of this project is to transform the existing cross-border payment platform into a comprehensive, user-centric super app that delivers seamless financial services on a global scale. By integrating remittance, insurance, bill payments, and e-KYC functionalities within a single ecosystem, the app aims to:

Enhance User Convenience by offering multiple financial services through one unified platform.

Improve Transaction Efficiency through faster, transparent, and cost-effective cross-border payments.

Expand Market Reach by appealing to large retail clients and diverse international users.

Ensure Compliance and Security via robust e-KYC and regulatory frameworks.

Deliver an Exceptional User Experience with a modern, intuitive interface supporting both light and dark modes across Android and iOS devices.

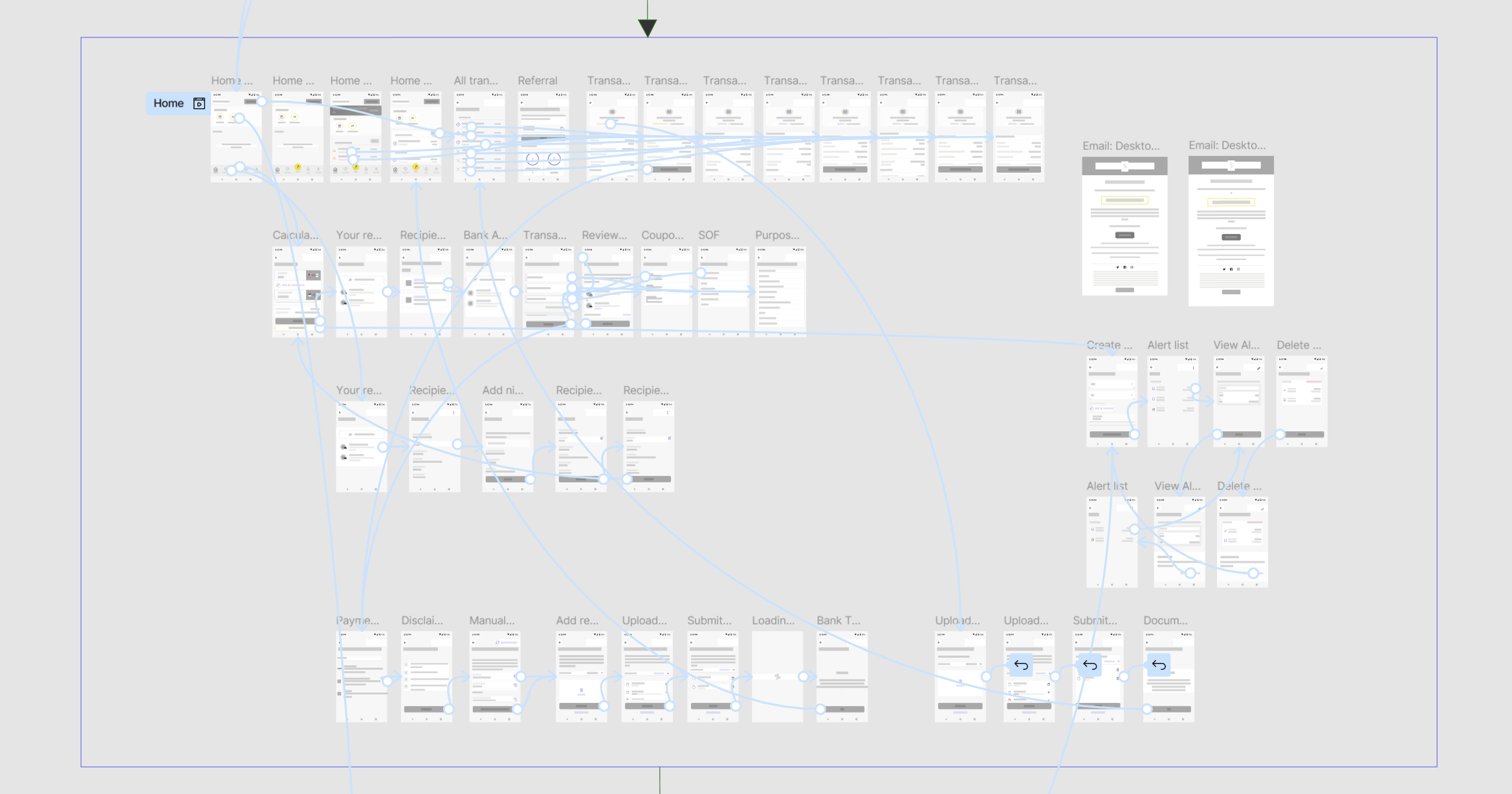

Design Process

Empathize

Define

Ideate

Test

Prototype

User research

User Research Summary

To guide the redesign of the cross-border payments application, user research was conducted among both existing customers and potential new users across key remittance markets. The goal was to understand user behaviors, pain points, and expectations around digital financial services. Key insights include:

Mobile-First Expectations: A majority of users access services via smartphones. They value simple navigation, intuitive design, and customization options like dark mode and multilingual support.

Trust and Transparency Are Critical: Many users cited hidden fees and unclear exchange rates as major deterrents. Transparent pricing and real-time tracking were top priorities.

Speed and Reliability Matter Most: Cross-border transfers are often delayed or inconsistent. Users want faster transactions and instant confirmations for peace of mind.

Onboarding and Verification Friction: The KYC process was seen as cumbersome, requiring physical documents or long approval times. Users desire a smooth digital e-KYC experience.

User Pain Points

1

Inconvenient Login & Device Management

Users experience frequent logouts, multiple login prompts, and difficulty accessing their accounts across devices — leading to frustration and interrupted sessions.

2

High Fees and Lack of Transparency:

Users are frustrated by hidden charges and unclear exchange rates in existing remittance services.

3

Complex Onboarding and Verification:

Lengthy or manual KYC processes create friction and discourage new users from completing registration.

4

Unreliable Registration and Form Process:

Important user-entered data (like beneficiary or bank details) is often lost due to session timeouts or network errors, forcing users to re-enter information repeatedly.

Competitor Analysis

Conducting research on leading fintech competitors in the market is crucial for understanding the landscape. This analysis enables me to identify their strengths and weaknesses, providing insights that can inform my current project. I focused on three primary competitors whose business models closely align with ours.